The goods and services tax (GST) is an indirect taxation system introduced in 2017 in India. Individuals and entities with a turnover of more than ₹20 lakh (service-based businesses) and ₹40 lakh (goods-based businesses) must mandatorily apply for GST registration.

One of the most important documents that serves as proof of registration under this indirect taxation system is the GST certificate. The document is essential for legal compliance, GST return filing and conducting business transactions. Without a GST registration certificate, you cannot levy the tax on the goods and services you provide.

In this article, we will explore the GST registration certificate in detail, its significance and how to download it.

GST Registration Certificate: An Overview

A GST registration certificate is an official document issued after you successfully register under the goods and services taxation system. It acts as proof that you are legally authorised to collect and remit GST.

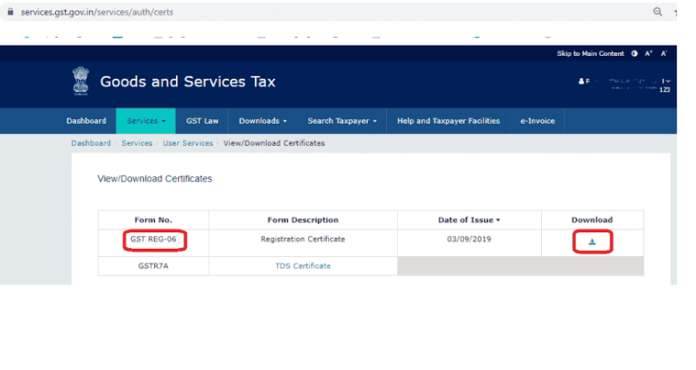

The GST registration certificate is issued in Form GST REG-06 and contains key information such as the GST identification number, details of your business, details of the jurisdictional authority, validity period and type of registration. The certificate is system-generated and signed digitally.

Every individual and business entity registered under the goods and services taxation system must display their GST certificate prominently in their place of business.

Key Components of a GST Registration Certificate

Here is a comprehensive overview of some of the key components of a typical GST registration certificate.

- GST Identification Number (GSTIN)

The GST Identification Number (GSTIN) is a unique 15-digit alphanumeric code assigned to your business after registration. The first two digits represent the state code, the next ten digits are based on your PAN, the thirteenth digit signifies the registration number within the state, the fourteenth is by default ‘Z’, and the last digit is a checksum code. The gstin number is mandatory for all tax-related transactions and must be mentioned in all invoices.

- Legal Name of the Business

This section displays the legally registered name of the business as per the goods and services taxation system.

- Trade Name of the Business

Not all individuals and entities use their legally registered name to conduct business. Some might even have a separate trade name or a brand under which they sell goods and services. This section displays the various trade names of the business, if there are any.

- Constitution or Type of Business

Businesses can be of many types, ranging from a sole proprietorship or partnership to a private limited or public limited company. You can find the type of business mentioned in this section of the GST registration certificate.

- Address of the Principal Place of Business

This section contains the address where the business is primarily conducted from. GST authorities usually conduct compliance checks periodically to verify the authenticity of the location.

- Date of Liability

This section contains the date on which you become liable to get GST registration. To simplify, the date of liability would be the date on which you cross the GST turnover threshold. In the case of voluntary registration, this section would be left blank.

- Period of Validity

This section contains the date from which the GST registration is valid and the date on which it expires.

- Type of Registration

This section mentions the type of registration you opted for. The different types of GST registration you can opt for include the following:

- Regular

- Composition Scheme

- Casual Taxable Person

- Non-Resident Taxable Person

- Tax Deducted at Source (TDS) and Tax Collected at Source (TCS)

- Input Service Distributor (ISD)

- UN Bodies, Embassies or Other Notified Persons

- E-Commerce Operator

The section also contains a QR code, which, upon scanning, will display all of the information mentioned in the certificate. The QR code is often used to verify the authenticity of the certificate and the details mentioned therein.

- Particulars of Approving Authority

This section contains details of the authority that approved the business or individual gst calculator. It features the name and designation of the approving officer, details of the jurisdictional office and the digital signature of the GST authority.

- Date of Issue of Certificate

This section features the date on which the GST registration certificate was issued. This date may vary depending on when you download the certificate from the GST portal.

Significance of the GST Registration Certificate

The GST registration certificate is of immense significance. Here are some key reasons why it is considered a very important document.

- Legal Compliance

If your turnover exceeds the threshold limits mentioned in the goods and services tax act, you must register and apply for a GST certificate. Additionally, you must also display the registration certificate prominently in your place of business. Failure to do so can result in penalties, legal consequences and restrictions on business operations.

- Business Transactions, Invoicing and GST Return Filing

If you supply goods or services, you must include your GST identification number on invoices. Additionally, you would also need the GSTIN to submit your e-return and comply with GST return filing requirements.

The number is mentioned prominently on the registration certificate, making it an essential document for all GST-registered businesses. Also, many suppliers, vendors and clients may request a copy of the GST certificate before engaging in financial transactions to ensure that you are properly registered under the act.

- Bank Account Opening

Since a GST registration certificate serves as proof of business legitimacy, many banks might require you to produce it at the time of opening a bank account for your business.

Step-by-Step Guide to Downloading the GST Registration Certificate

Knowing how to download the certificate is crucial, irrespective of whether you have a business or individual GST registration. Fortunately, it is a simple process that can be done through the GST portal. Here is a step-by-step guide you can follow to download your GST registration certificate.

- Step 1: Once you have completed the business or individual GST registration process, visit the GST portal.

- Step 2: Click on the ‘Login’ option on the top right corner of the website.

- Step 3: Use your credentials to log into your account.

- Step 4: Click the ‘Services’ tab on the webpage.

- Step 5: Click ‘User Services’ and then on the ‘View/Download Certificates’ option.

- Step 6: You can find all of the GST registration certificates issued by the authorities in this section of the webpage. Click on the download icon beside the registration certificate that you wish to download.

- Step 7: The registration certificate will be automatically downloaded to your device in PDF format.

Note: It is important to note that the GST authorities do not provide any physical registration certificates. You can only download it online through the GST portal by following the steps outlined above.

Conclusion

Downloading your GST registration certificate is an essential step once you are registered under the goods and services taxation system. The certificate not only serves as proof of compliance with the various GST tax laws it also helps you file e-returns smoothly and facilitates business transactions. Moreover, you must display your GST certificate prominently in your place of business as per law. Failing to display the certificate can lead to penalties or maybe even legal action.